Federal Solar Tax Credit Under Threat: What Colorado Homeowners Need to Know

Federal Solar Tax Credit Under Threat: What Colorado Homeowners Need to Know

A new bill introduced by four Republican members of the House of Representatives is aiming to phase out the federal solar and wind tax credits that have driven massive investment in clean energy. Known as the Ending Intermittent Energy Subsidies Act, the proposal would reduce the Investment Tax Credit (ITC) and Production Tax Credit (PTC) by 20% annually over five years, starting the year the bill is passed. It would also eliminate the ability to transfer tax credits, a key feature that’s helped bring over $500 billion in private capital to renewable energy projects since 2022.

While the bill does not target other technologies like nuclear or geothermal, it takes direct aim at solar and wind — technologies the sponsors now consider “mature” and no longer in need of incentives. However, a report from NERA Economic Consulting warns that repealing these tax credits could raise residential electricity bills by an average of 7% and commercial bills by 10% by 2026.

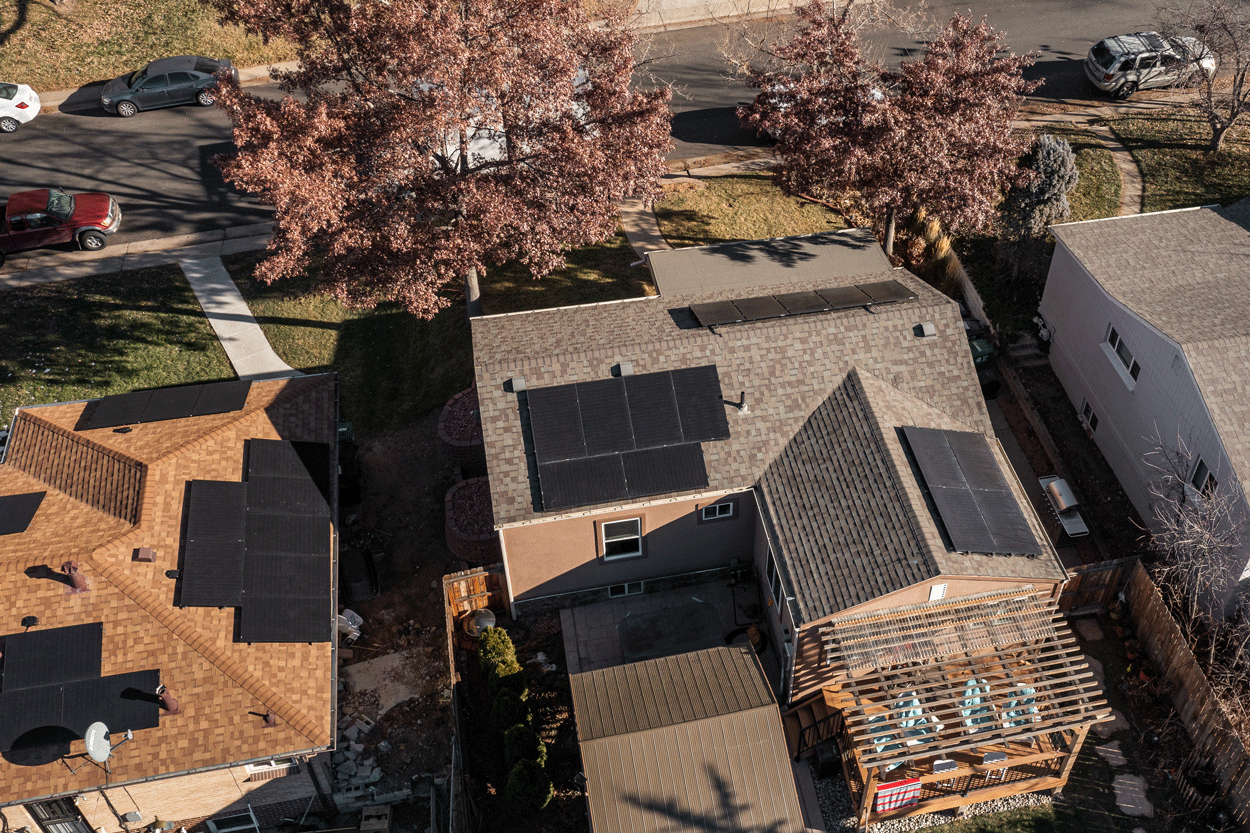

At Solar Wave, we believe the tax credit has been essential in helping Colorado families and businesses take control of their energy costs and reduce reliance on the grid. The current 30% Federal Investment Tax Credit is still active and available for new solar and battery storage projects — but these benefits may not last forever.

If you’ve been considering going solar or adding a backup battery system like the Tesla Powerwall 3 or Enphase 5P, now is the time to act. Take advantage of the full 30% tax credit while it’s still in place.