Commercial Solar Energy Systems

We are experts at evaluating, designing, and installing small to large-scale commercial solar energy projects on time and on budget.

Why solar energy for your commercial property makes sense.

-

You can reduce your operating expense

-

You can receive a great ROI

-

You can add equity to your property

-

You can take advantage of local & federal tax incentives

-

You can reduce your carbon footprint & position your company as eco-friendly

Request a proposal for your property

Evaluating a commercial solar project for your property all starts with an analysis of your energy usage. Start the process with one of our experts today. We will develop a custom design and financial proposal complete with available incentives and financing options.

Colorado Commercial Solar Incentives

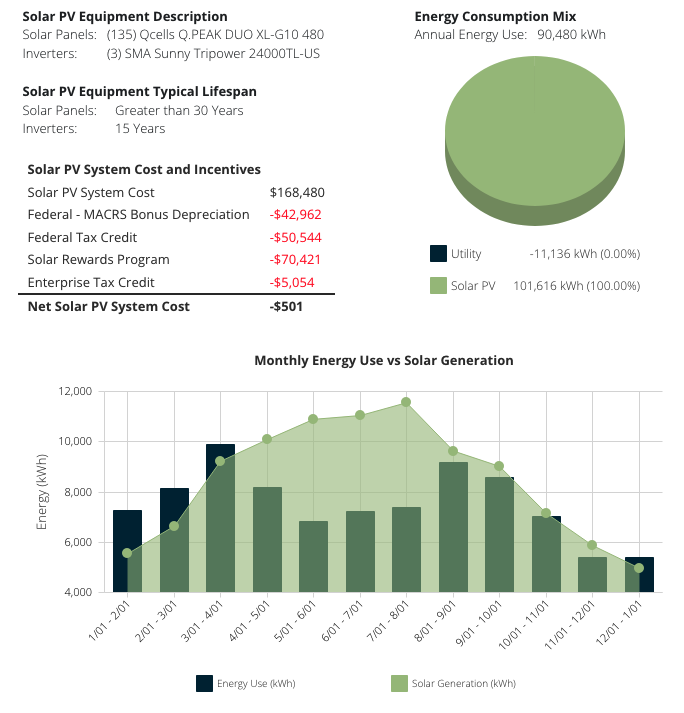

Commercial Investment Tax Credit (ITC)

The Inflation Reduction Act (IRA) of 2022 establishes and extends the federal Investment Tax Credit (ITC) for solar photovoltaic (PV) systems at a rate of 30% of the total PV system cost. The 30% ITC was extended for 10 years, through 2032. Unlike tax deductions, this tax credit can be used to directly offset your tax liability dollar for dollar. The IRA extended the carryback period to 3 years, and the carryforward period to 22 years, in cases where the tax credit exceeds a customer’s tax liability in the ‘placed-in-service’ year.

Federal MACRS, Bonus Depreciation

Under the federal Modified Cost Recovery System (MACRS), businesses may recover investments in solar PV property through depreciation deductions over a 5-year established lifespan. For PV systems, the taxable basis of the equipment must be reduced by 50% of any federal tax credits associated with the system. Projects placed in service in 2023 qualify for 80% bonus depreciation, which means in the first year of service, companies can elect to depreciate 80% of the basis while the remaining 20% is depreciated under the normal MACRS schedule.

USDA - Rural Energy for America Program (REAP) grant

The Rural Energy for America Program (REAP) provides financial assistance to agricultural producers and rural small businesses to purchase, install, and construct renewable energy systems. The REAP grant solicitation states that to be eligible, an applicant must have a satisfactory revenue stream and be in control the budget, operations, and maintenance of a project for the entire duration of the loan or grant. Rural small businesses must be located in rural areas, but agricultural producers may be located in non-rural areas. Per the Inflation Reduction Act (IRA), signed into law on 8/16/2022, the REAP grant can cover up to 50% of the cost of a project, doubling the existing grant-based cost-share level of 25%.

Colorado Enterprise Zone (EZ) - Corporate Tax Credit

A taxpayer may claim an EZ investment tax credit for qualified investments located in an enterprise zone. The income tax credit is equal to 3% of the investment. A taxpayer can claim up to $750,000 during any tax year for eligible renewable energy. System Cost Less than $25 Million

Xcel Energy Solar Rewards Program

Xcel Energy's Solar*Rewards Program provides incentives for customers who install grid-connected photovoltaic (PV) systems sized up to 120% of the average annual load of their homes and facilities in exchange for the renewable energy credits (RECs) produced by the systems. All REC purchases are for a period of 20 years unless other legal provision supersedes. The size of the REC payment depends on the size of the system and the owner of the system. These payments will step down over time as distinct capacity levels, in megawatts (MW), are reached for each system classification.