Introduction

It’s no secret, that more and more homeowners across the United States are adopting solar energy as their preferred energy source. But what makes solar a good investment? This article will discuss what makes solar an investment worth considering for your home or business. To start we will discuss the problems with continuing to source your power from a utility company and then we will discuss the benefits solar energy offers. To close out the article, we will discuss an example solar investment including an example return on investment.

What you are doing now for electricity

To start let’s discuss what most homeowners are still doing; sourcing their energy from a utility company. If you are reading this article odds are you still get your electricity from a utility company.

I think it's safe to say that although your utility company serves a purpose, you would choose to live without them if you could. Here are a few reasons why:

- Energy rates continue to increase

- This probably isn't news to you but your utility company is not going to lower your rates anytime soon. In fact, rates continue to increase year over year.

- You have no control over your power

- If the grid experiences a failure then you are left without power and this often occurs when you need it most.

- You likely do not have multiple utility companies to choose from

- Most utility companies have no competition which means there is no reason for them to offer better pricing.

- The majority of power from your utility company comes from burning fossil fuels

- No secret here, the majority of power from your utility company comes from burning coal and natural gas

- You have to pay a bill every month & that bill will never go away

- Have you considered what your bill will be in 10 years? Or how much you will spend on utility bills in 20 years?

Solar Energy as a Solution

Solar energy creates a unique alternative to sourcing your electricity. Rather than continuing to pay your utility company for electricity, you can invest in a solar panel system and produce your own electricity right from your roof. Here are some benefits to consider:

- Solar protects you from future utility inflation

- The sun never changes its cost of sunlight so your cost to produce energy stays the same.

- Solar can provide power when the grid is down

- Not all systems are capable of backing up your home, but add a battery and you could be completely energy independent

- Solar is a clean energy source

- You can do your part to contribute to a cleaner environment and a brighter future

- You can pay for your system outright and enjoy annual returns or finance, and have a manageable payment with an end date

- With solar, you choose how you would like to pay for your energy

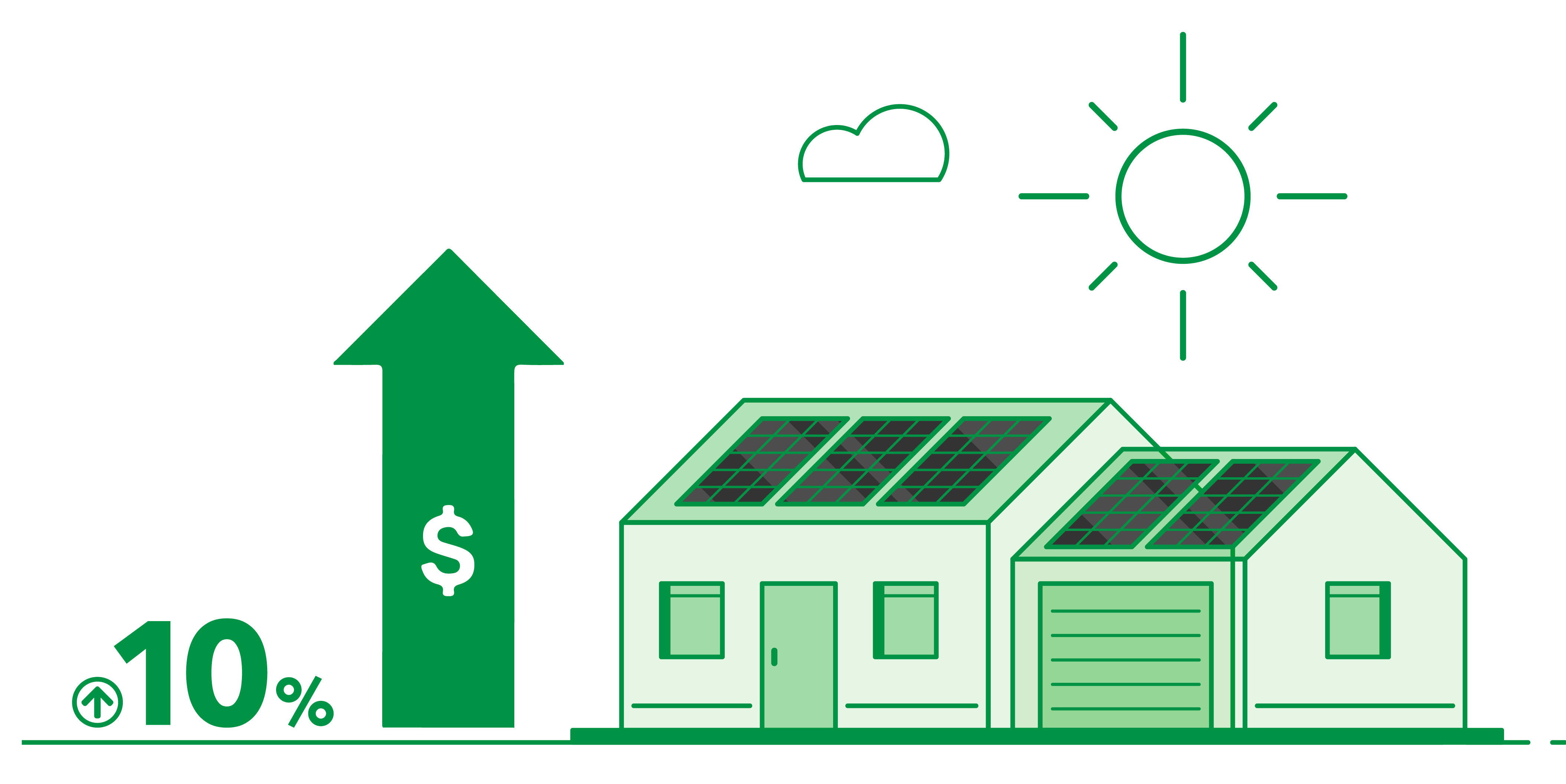

- Solar adds value to your home

- Unlike throwing money away to your utility company when you invest in solar you can get value back out of your system

Calculating Your Investment

Now that we have covered why solar energy makes sense in comparison to your utility company, let's jump into the numbers and see if the financials pencil out. For this section, I will be using an example utility bill and solar system size. Your actual numbers will vary from this example, but the calculations will be the same. If you want a custom financial breakdown on a system designed specifically for you, head over to our start proposal page by clicking here.

Example utility expense

Let's say you are like most homeowners and you spend $120.00 on electricity per month. Here are a couple of quick numbers to calculate:

Annual utility expense: $1,440.00

Utility expense after 10 years: $14,400.00

Utility Expense after 15 years: $21,600.00

Utility expense after 25 years: $36,000.00

Example utility expense with Inflation

To see what our example utility expense with inflation would be, we will need to use a more advanced formula. I use a spreadsheet like this one to properly calculate annual inflation. After plugging in our average bill of $120 here are the calculations:

Utility expense after 10 years with 3.5% annual inflation: $16,893.00

Utility Expense after 15 years with 3.5% annual inflation: $27,785.00

Utility expense after 25 years with 3.5% annual inflation: $56,087.00

These numbers will serve as our utility expense comparison against a solar energy investment which we will calculate next.

Example system size and expense

A lot of factors go into sizing a solar panel system. By far the best way to get an accurate system size and quote is by requesting a customized solar proposal from Solar Wave. But to keep it simple, for this scenario we can install an 8KW system that would produce enough energy to offset 100% of a $120 bill. Below you will find the financial details for this hypothetical system, priced using Solar Wave's transparent flat-rate pricing.

System Size: 8KW

System Price: $25,600.00

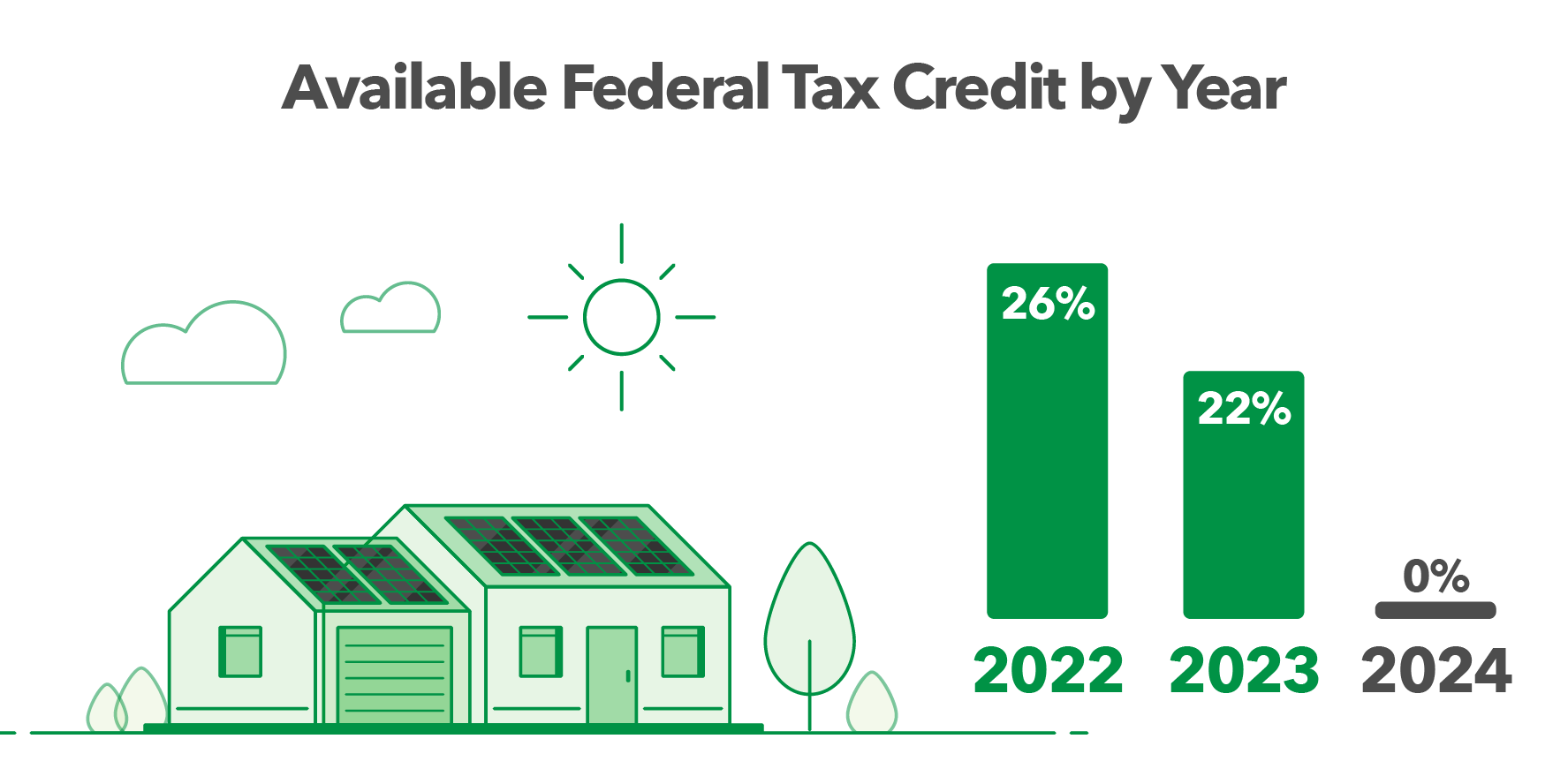

Federal Tax Incentive: $6,656.00

Solar Net Investment: $18,944.00

As you can see, after applying the eligible federal tax incentive, an 8KW solar panel system capable of producing $120 in energy per month and $1440 of energy per year would cost just $18,844.00.

Evaluating The Solar Investment

Now that we have the numbers we need, let's evaluate this solar energy investment. The first and easiest calculation we can make would be the net savings and estimated savings based on inflation.

Net Savings Calculation

Net Savings = Utility expense after 25 years - Solar Net Investment

Net Savings = $36,000 - $18,944

Net Savings = $17,056

Estimated Savings Calculation

Estimated Savings = Utility expense after 25 years with 3.5% annual inflation - Solar Net Investment

Estimated Savings = $56,087 - $18,944

Estimated Savings = $37,143

Savings Example Summary

For this example, our net savings is $17,056.00 and our estimated savings are $37,143.00. So basically if your utility company loves you and decides to never raise your utility rates again, an 8KW system will save you $17,056.00 over its 25-year lifetime. Now consider the realistic potential for future utility rate increases and this 8KW system can save you $37,143.00.

Not bad! Like most financials, there are multiple calculations to consider. Next up let's calculate return on investment (ROI) numbers and payback periods.

ROI & Payback Calculations

Year one ROI

This is a great calculation to know what your investment would yield in its first year not considering any future inflation.

Year one ROI = year one production value / Solar Net Investment

In this example our year one production value is $1440

Year one ROI = $1440/$18,944.00

Year one ROI = 7.6%

Calculating Your Payback Period

For the payback period, we can run two scenarios: one without utility inflation and one with utility inflation.

Payback without utility inflation

Payback without utility inflation = Solar Net Investment / Annual production value

Payback without utility inflation = $18,944 / $1440

Payback without utility inflation = 13 years

Payback with utility inflation

Payback with utility inflation requires the use of a spreadsheet like this one to calculate. Here is the result after plugging in the correct numbers.

Payback with utility inflation = Just under 10 years!

The Bottom Line

Investing in a solar energy system is your chance to turn an energy expense that will never go away into an investment. Your system's return on investment can be 10% or higher and your payback can be under 10 years. Even better, according to sources like Zillow and Energy.gov, you will also be able to sell your home for more in the future if it has solar.

The Catch

Like most things that sound too good to be true, there is a catch. Solar is not a "one size fits all". It all comes down to your current utility expense and if you have any limitations to installing a perfectly positioned solar panel system. By far the best way to evaluate your unique scenario is to receive a free and 100% online custom proposal from Solar Wave. Head over to our start proposal page by clicking here.

If you have already submitted your information and you are reading this article in preparation for your proposal review with us, then we look forward to evaluating your solar energy investment with you very soon!

As always, if you have any questions or feedback about this article please reach out to us or leave a comment below.

Financial Advice Disclaimer:

I’m not a certified financial planner/advisor nor a certified financial analyst. I’m a solar enthusiast who believes and takes pride in a sense of freedom, satisfaction, fulfillment, and empowerment that I get from being financially competent and conscious of my energy expenses and options. The contents of this article and site are for informational purposes only and do not constitute financial, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using this site, you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this site.