Colorado Solar Incentives

Introduction

Solar rebates and incentives have long played a crucial role in advancing the solar and renewable energy industry. These incentives lower your investment and in most cases make purchasing a solar panel system more attractive for your home or business. In this article, we will cover some if not all the solar incentives currently available in Colorado at the federal, state, and local levels.

Keep in mind some of the language used is sourced from the incentive provider directly. Links for all incentives are included under the description and if you have any questions about which incentives you may qualify for reach out to us today. All our solar proposals come with eligible incentives based on your specific solar project.

Federal Programs & Incentives

Federal Investment Tax Credit (ITC)

A taxpayer may claim a credit for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer. Expenditures with respect to the equipment are treated as made when the installation is completed. If the installation is at a new home, the "placed in service" date is the date of occupancy by the homeowner. Expenditures include labor costs for on-site preparation, assembly or original system installation, and for piping or wiring to interconnect a system to the home. If the federal tax credit exceeds tax liability, the excess amount may be carried forward to the succeeding taxable year. The maximum allowable credit, equipment requirements, and other details vary by technology, as outlined below.

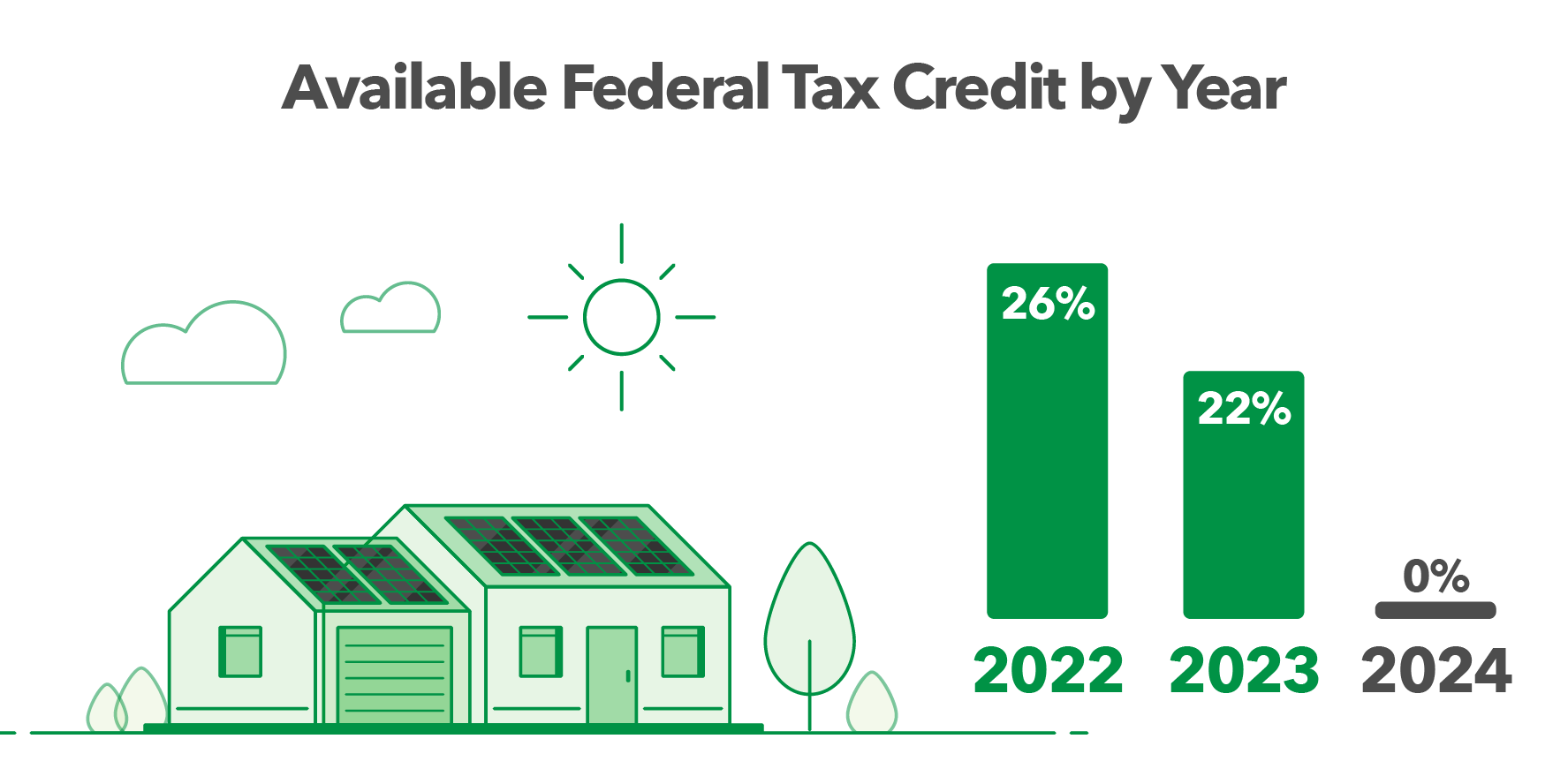

Solar-electric property

30% for systems placed in service by 12/31/2019

26% for systems placed in service after 12/31/2019 and before 01/01/2023

22% for systems placed in service after 12/31/2022 and before 01/01/2024

There is no maximum credit for systems placed in service after 2008. Systems must be placed in service on or after January 1, 2006, and on or before December 31, 2023. The home served by the system does not have to be the taxpayer’s principal residence.

Energy Storage

The federal tax code does not explicitly reference energy storage, so stand-alone energy storage systems do not qualify for the tax credit. However, the IRS issued Private Letter Rulings in 2013 and 2018, which address energy storage paired with PV systems. In both cases, the IRS ruled that the energy storage equipment when paired with PV met the statutory definition of a "qualified solar electric property expenditure," as was eligible for the tax credit. It is important to note that Private Letter Rulings only apply to the taxpayer who requested it and does not establish a precedent. Any taxpayer considering the purchase of an energy storage system should consult their accountant or other tax professional before claiming a tax credit.

Source: https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

Modified (MACRS)

Under the federal Modified Accelerated Cost-Recovery System (MACRS), businesses may recover investments in certain property through depreciation deductions. The MACRS establishes a set of class lives for various types of property, ranging from three to 50 years, over which the property may be depreciated. A number of renewable energy technologies are classified as five-year property under the MACRS.

Bonus Depreciation

Bonus Depreciation has been sporadically available at different levels during different years. Most recently, The Tax Cuts and Jobs Act of 2017 increased bonus depreciation to 100% for qualified property acquired and placed in service after September 27, 2017 and before January 1, 2023.

Effectively you can depreciate your solar investment as long as you are a business.

Source: https://www.seia.org/initiatives/depreciation-solar-energy-property-macrs

USDA REAP Grant

The Rural Energy for America Program (REAP) provides financial assistance to agricultural producers and rural small businesses in America to purchase, install, and construct renewable energy systems, make energy efficiency improvements to non-residential buildings and facilities, use renewable technologies that reduce energy consumption, and participate in energy audits and renewable energy development assistance.

Grants and Guaranteed Loans are generally available to small businesses and agricultural producers and other entities as determined by USDA. To be eligible for REAP grants and guaranteed loans, applicants must demonstrate sufficient revenue to cover any operations and maintenance expenses as well as any applicable debt service of the project for the duration of the guaranteed loan or grant. Rural small businesses must be located in rural areas, but agricultural producers may be located in non-rural areas.

Eligible project costs include purchasing energy efficiency improvements or a renewable energy system, energy audits or assessments, permitting and licensing fees, and business plans and retrofitting. For new construction, the replacement of older equipment with more efficient equipment may be eligible as a project cost only when a new facility is planned to be more efficient and similarly sized to the older facility. Working capital and land acquisition are only eligible for loan guarantees.

Renewable Grants: $2,500-$500,000 - maximum incentive 25% of project cost

Source:http://www.rd.usda.gov/reap

Colorado State Incentives

Colorado Solar Sales and Use Tax Exemption

Colorado exempts from the state's sales and use tax all sales, storage, and use of components used in the production of alternating current electricity from a renewable energy source for fiscal years beginning on or after July 1, 2006. The exemption for systems that produce electricity from a renewable resource includes, but is not limited to, photovoltaic (PV) systems, solar thermal electric systems, small wind systems, biomass systems, or geothermal systems.

Source: https://tax.colorado.gov/sales-tax-exemptions-deductions

Colorado Solar Property Tax Exemption

Renewable energy personal property that is located on a residential classified property, owned by the residential property owner, and produces energy that is used by the residential property is exempt from Colorado property taxation.

Source: https://cdola.colorado.gov/renewable-energy

Local County/Municipality/Utility Incentives

Xcel Energy Net Metering

Net metering is available for Xcel Energy's customers, with net excess generation (NEG) at the end of a monthly billing period credited to the next month’s bill. If a customer has NEG at the end of a calendar year, the customer will be paid for the credit at a rate comparable to the utility's avoided-cost rate, or the customer may make a one-time election to have the NEG carried forward from month to month indefinitely as a kilowatt-hour credit.

Source: https://co.my.xcelenergy.com/s/renewable/net-metering

Xcel also has a solar rewards program

Xcel Energy's Solar*Rewards Program provides incentives for customers who install grid-connected photovoltaic (PV) systems sized up to 120% of the average annual load of their homes and facilities. Xcel purchases the renewable energy credits (RECs) produced by the systems for a period of 20 years (unless other legal provision supersedes). The size of the REC payment depends on the size of the system and the owner of the system, as shown below. The follow REC payments are in effect as of November 2015. Check the website above for changes to REC pricing.

For more information, visit the program website or view Xcel Energy's approved 2014 Renewable Energy Standard Plan.

Small Program (0.5 – 25 kW) – Standard Offer

The Small Program offers payments of $0.005 per kilowatt-hour (kWh) for eligible systems. The annual capacity limit for the Small Program is 12 MW.

Medium Program (25.1 kW – 500 kW) – Standard Offer

The Medium Program offers a payment of $0.0375 per kWh for eligible systems. Up to 12 MW of capacity will be approved for each half of the year, for an annual capacity limit of 24 MW.

Source: https://co.my.xcelenergy.com/s/renewable/solar-rewards

Black Hills Energy - Solar Power Program

Black Hills Energy has a performance-based incentive (PBI) for photovoltaic (PV) systems up to 500 kilowatts (kW) in capacity. In exchange for a PBI, Black Hills Energy earns the renewable energy credits (RECs) associated with the PV-generated electricity for a period of time.

Systems sized 0.5 kW - 30 kW: $0.030 per kWh is paid over a 10-year period

Systems sized 30.001 kW - 500 kW: $0.060 per kWh is paid over a 10-year period

Source: https://www.blackhillsenergy.com/services/colorado-solar-program/private-site-solar-program

San Miguel Power Association Rebate Program

San Miguel Power Association (SMPA) is providing rebates to its residential and commercial customers for installing photovoltaic (PV), small wind, and solar water heating systems as well as other renewable energy systems (e.g., micro-hydro, biomass) on a case-by-case basis. Applicants must own the system to qualify for the rebate. Systems leased from a third party are ineligible.

The incentive is 0.50 $/W, The incentive has a maximum of $1500.00, The system size has a maximum of 3.00 kW

Source: http://www.smpa.com/content/renewable-rebates

La Plata Electric Association

La Plata Electric Association (LPEA) offers an incentive, not to exceed the cost of the system, to residential and small commercial customers who install a photovoltaic (PV), wind, or hydropower facility. To be eligible for the rebate, the system must be grid-tied and located in LPEA's service territory. Systems 10 kilowatts (kW) or less are eligible for an upfront incentive based on the nameplate capacity and other factors. Systems greater than 10 kW are eligible for a performance-based incentive.

Payments are made every 6 months for the first 10 years of operation.

PV 10 kW-DC or less: Upfront incentive of $16 per kW

PV greater than 10 kW-DC: Performance-based incentive is paid every 6 months for 10 years, currently $1.oo per MWh

Check LPEA website for future REC values.

Source: https://www.lpea.coop/rec-payment-tax-incentives

Holy Cross Energy Rebate Program

Holy Cross Energy's WE CARE (With Efficiency, Conservation And Renewable Energy) Program offers an incentive for customers who install renewable energy generation for net metering at their premises. Eligible renewable energy technologies include wind, hydroelectric, photovoltaic, biomass, and geothermal sources.

The incentive offered varies by the size of the renewable energy system as follows:

$500 per kW for the first 6 kW of a system,

$335 per kW for the next 6 kW of a system, and

$150 per kW for the next 13 kW of a system.

For example, a 15 kW system is eligible for a $5,460 (= ($500 * 6 kW) + ($335 * 6 kW) + ($150 * 3 kW)) incentive.

For non-taxable entities, Holy Cross will provide an incentive equal to 40% of the installed cost of a system (on a $ per KW basis) up to $1,000 per kW for the first 25 kW installed at a site.

Energy storage systems of up to 25 kW are eligible for an incentive of $250 per kW

Source: https://www.holycross.com/renewable-energy-incentives/

Colorado Springs Utility Rebate Program

Through its Renewable Energy Rebate Program, Colorado Springs Utilities (CSU) offers a rebate to customers who install grid-connected solar-electric (photovoltaic, or PV) systems. To calculate the PV system’s AC output, a de-rating factor is used to account for shading and suboptimal orientation or tilt.

All Renewable Energy Credits (RECs) generated from systems installed under this program are transferred to CSU for compliance with Colorado’s renewable portfolio standard.

PV: $0.10 per watt

Eligible systems: Residential PV: 0.5kW - 15kW, Commercial PV: 0.5kW - 100kW

Source: https://www.csu.org/Pages/RenewableRebate.aspx

The City Of Aspen Rebate Program

The City of Aspen encourages interested residents and businesses to increase the energy efficiency of homes and offices through rebates and incentives for both single-family and multi-family dwellings. Rebates are available for geothermal heat pumps, solar photovoltaics, air sealing, insulation, water heaters, lighting, and refrigerators. Custom rebates are available for incentives not specifically offered by the utility but require pre-approval.

$0.75/installed watt up to 3KW or $2,250

Source: https://www.cityofaspen.com/543/Energy-Efficiency

City of Boulder Solar Grant Program

The Solar Grant Program provides grants for PV and solar water heating installations on income-qualified homes, site-based non-profit organizations, and low- to moderate-income housing owned and/or developed by a non-profit organization. Individual grant amounts are determined on a case-by-case basis but generally will not exceed 50% of the total out-of-pocket costs for the project after all rebates, tax credits, and other incentives are subtracted. There are two grant cycles each year. Submissions are due by April 30 and October 31. Additional information and grant applications can be found on the website listed above.

Source: https://bouldercolorado.gov/solar/solar-rebate-and-solar-grant-programs

Summary

There are many Colorado solar incentives available. Ultimately whether you can qualify for each incentive will come down to the specifics of your project. For residential projects, the two most common incentives our customers qualify for are the Federal tax credit (ITC) and Xcel Energy's Net metering program. For our business clients The Federal tax credit (ITC), MACRS, and Net metering are the most common. If you have any questions about this article or you are ready to learn exactly what incentives your solar project can qualify for reach out to us today to start a solar proposal by clicking here.

If you want to leave a comment I welcome you to do so below.